Kenya Terrorist Financing

The concept of money laundering is essential to be understood for those working in the financial sector. It's a process by which soiled cash is transformed into clear cash. The sources of the cash in actual are felony and the money is invested in a means that makes it appear to be clear cash and hide the identification of the legal part of the money earned.

While executing the financial transactions and establishing relationship with the new clients or sustaining current prospects the obligation of adopting enough measures lie on each one who is a part of the organization. The identification of such ingredient in the beginning is simple to cope with instead realizing and encountering such situations afterward within the transaction stage. The central bank in any country offers full guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to deter such conditions.

The latest findings by Kenyan Police in their investigations into the 15 January 2019 terrorist attack in Nairobi Kenya highlights the increased need for the implementation of proper anti-money laundering AML procedures by financial institutions. Definition of Financial Institution under FATF standards Financial institutions means any natural or legal person who conducts as a business one or more of the following activities or operations for or on behalf of a customer.

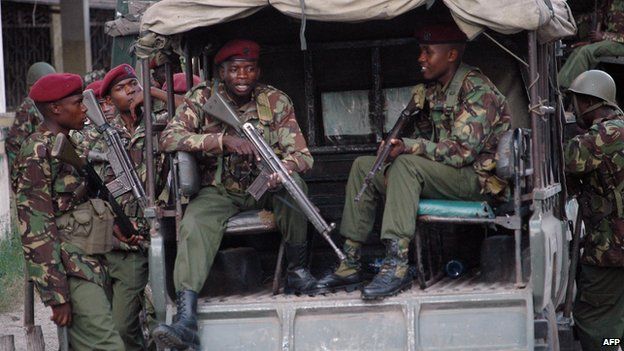

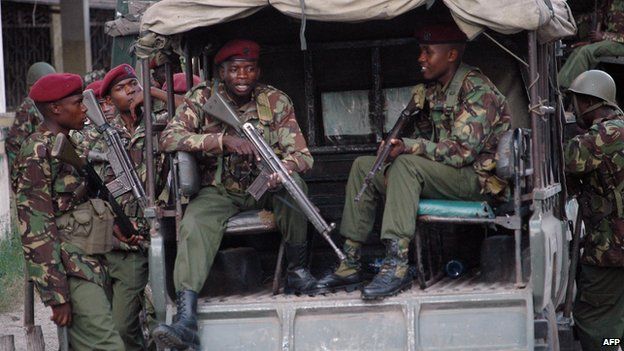

Kenya Thousands Of Muslims Commemorate Terror Victims

The Kenyan Parliament is working on legislation focused on reducing terrorism.

Kenya terrorist financing. As terrorist forces have grown in strength the central government in Nairobi has invested more resources to disrupt terrorist financing and thwart their operations. This threat includes small terrorist cells or individual terrorists capable of committing attacks and significantly harming society. The regional videoconferences set the stage for additional regional dialogues that aim to expand the international knowledge base on money laundering and terrorist financing.

Legal Alert Reducing the Risk of Financing Terrorism. Combatting the financing of terrorism CFT continues to be a priority for the FATF given the threats posed by terrorist organisations. In April 2015 the Kenyan government began construction of a wall along Kenyas Somali border to keep.

Consequently Kenya has not been left behind in the worldwide fight against money laundering. There have been a number of other terrorist attacks in Kenya in recent years. On 15 to 16 January 2019.

The Guidance Note clarifies the regulatory requirements under Kenyas Anti-Money Laundering and Combating Financing of Terrorism legislation on the process of undertaking MLFT risk assessment. Acceptance of deposits and other repayable funds from the public 2. Clause 55 of the Central Bank of Kenya CBK Prudential Guidelines on Anti-Money Laundering and Combating the Financing of Terrorism CBKPG08 requires a reporting institution to undertake a Money Laundering ML and Terrorism Finance TF risk assessment to enable it identify assess monitor manage and mitigate the risks associated.

In Kenya many Financial Institutions FI and non-FI institutions providing financial services such as those regulated under the National Payment Systems Act 2011 currently use rule. The mandate of the FATF is to set standards and to promote the effective. Kenya is a member of the Eastern and Southern Africa Anti-Money Laundering Group ESAAMLG which is in turn an Associate Member of the global Financial Action Task Force FATF.

She has signed and ratified all the UN Conventions on combating money laundering and terrorism financing and is also a member of a regional body. It is therefore important. The immediate objective is to strengthen national capacity to more effectively and comprehensively prevent investigate and prosecute terrorism counter-terrorism financing and money laundering in Kenya.

There is some evidence of growing support for Daesh formerly referred to as ISIL in Kenya. The Central Bank of Kenya has issued a Guidance Note on conducting money laundering ML and terrorism financing TF risk assessment by banking institutions. WHEREAS the Republic of Kenya has ratified the United Nations Conventions aimed at addressing terrorism and terrorism financing.

More precisely according to the International Convention for the Suppression of the Financing of Terrorism a person commits the crime of financing of terrorism if that person by any means directly or indirectly unlawfully and willfully provides or collects funds with the intention that they should be used or in the knowledge that they are to be used in full or in part in order to carry out an offense within. Task Force on the National Risk Assessment NRA on Money Laundering and Terrorism Financing. The FATF review found that Kenya had made progress by introducing laws to identify and freeze terrorist financing creating a more effective financial intelligence unit and penalizing people who did not comply with anti-money laundering rules.

The latest findings by Kenyan Police in their investigations into the 15 January 2019 terrorist attack in Nairobi Kenya highlights the increased need for the implementation of proper anti-money laundering AML procedures by financial institutions. There has been opposition from Muslim NGO and human rights groups. Alero Business DaillyKenya in Murky Anti-Terrorism War 4 th January.

As the focus of the investigation shifts. Kenya remains vulnerable to money laundering financial fraud and terrorism financing. The long-term objective of the project is to reduce incidences of terrorism financing of terrorism and money laundering in Kenya.

Being the major financial and trade hub in East Africa Kenya has been particularly vulnerable to money laundering and terrorist financing activities. A unit to combat the financing of terrorism. On the other hand Kenya is a country of dubious human rights record.

WHEREAS Kenya is a member of the United Nations and as such bound by the decisions and Resolutions of the United Nations Security Council by virtue of Article 41 of the Charter of the United Nations. In the context of AMLCTF a typology refers to the techniques or schemes used by criminals to launder illicit funds or finance a terrorist activity. Money laundering and the financing of terrorism cannot be effective in isolation from national and transnational governance or by merely adopting conventions and declarations.

Money laundering occurs in the formal and informal sectors deriving from domestic and foreign criminal operations. It is the financial hub of East Africa and is at the forefront of mobile banking. The bill aims to allow police to tap private communications seize property and access the bank details of suspected terrorists.

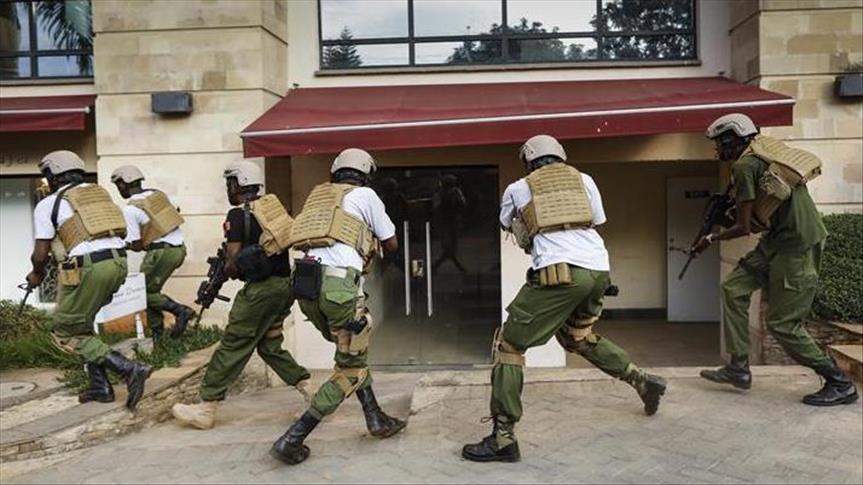

Us To Send Troops To Kenya To Boost Regional Security Report

Mombasa Muslim Businessman Accused Of Terror Links Killed Bbc News

Why Al Shabaab Targets Kenya And What The Country Can Do About It

Britain Funds 600 000 Anti Terror Center In Kenya

Kenya Terror Attack Aimed At Blunting Us Surveillance Capacity

News Analysis Mobile Money On Spot As Kenya Links Service To Terrorism Funding Xinhua English News Cn

Inside Kenya S War On Terror The Case Of Lamu Saferworld

Https Www Centralbank Go Ke Wp Content Uploads 2018 03 Guidance Note On Ml Tf Risk Assessment Pdf

Why So Many Al Shabaab Attacks On Kenya

Aml Certification In Kenya Regtechtimes

Why Is Al Shabab Making Inroads Into Kenya

When Al Qaida Brought Terror To East Africa Africa Dw 06 08 2018

Https Www Ira Go Ke Images Updates Anti Money Laundering Cft Training Pdf

The world of laws can seem to be a bowl of alphabet soup at times. US cash laundering rules aren't any exception. We've compiled a list of the top ten money laundering acronyms and their definitions. TMP Danger is consulting agency targeted on protecting monetary providers by reducing danger, fraud and losses. We've got massive financial institution expertise in operational and regulatory risk. We have a strong background in program management, regulatory and operational threat in addition to Lean Six Sigma and Business Course of Outsourcing.

Thus money laundering brings many adversarial consequences to the group as a result of risks it presents. It increases the chance of major risks and the opportunity value of the bank and ultimately causes the financial institution to face losses.

Comments

Post a Comment